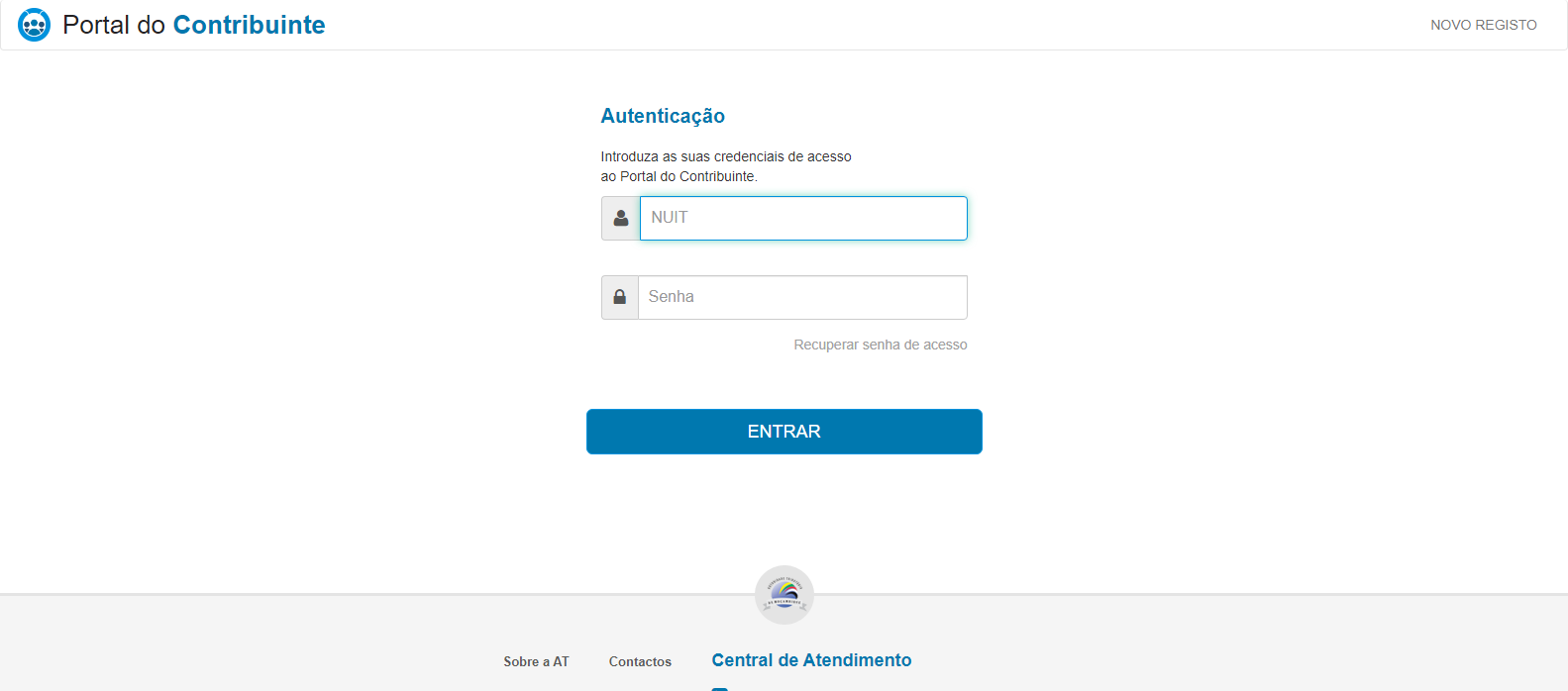

A Mozambique Tax Authority (AT) launched a new tax payment platform, called Taxpayer Portal, and which aims to ensure fiscal transparency, as well as facilitate taxpayer mobility and reduce corruption in the sector.

This new payment model comes to dissuade the long queues to pay taxes, system failures and illegal charges, which made taxpayers complain, at different posts in Mozambican territory, as well as to reduce the distance between the State and the taxpayer .

"The Taxpayer Portal is the means through which taxable persons will dynamically interact with the Tax Authority, in the fulfillment of their tax obligations, as well as access their tax information, without having to go to the collection units“, said the President of the AT, Amélia Muendane.

BUT: Mozambique: Taxation of the digital economy only in December 2022

According to the public manager, in this first phase of launching the Taxpayer Portal, the tool will include the administration of Value Added Tax (VAT) and Simplified Taxes for Small Taxpayers (ISPC), transmitting a remote communication between the Tax Authority and “taxpayer registration, submission of VAT and ISPC declarations, management of the taxpayer's current account, request for the discharge certificate, consultation of the taxpayer's tax situation and tax calculation simulation“, thus integrating the electronic taxation platform.

As an online platform, it is available to any Mozambican citizen, anywhere in the country, at any time, thus reducing constraints and complaints.

Amélia Muendane also assured that this technological transition that the institution she heads has been carrying out aims to put an end to various irregularities that harm the Mozambican State, mainly for informal and illegal trade.

"In 2021, the loss of revenue with registration, resulting from illegalities in the informal sector, were in the order of 11,6 million meticais and, this year, the country has already lost, in two months, 9,7 million meticais due to to illegal trade“, said the President of the AT.

One of the companies that has already tested the operability and functionality of the platform is Cervejas de Moçambique (CDM), which says that “one of the advantages we experience is the ease that this tool brings to the fulfillment of our tax obligations. This is because, from the comfort of your office or home, you can access the portal“, in the words of Hugo Gomes, representative of the company.